Greater returns can currently be found amongst lower scoring vintages from first growth vineyards of Bordeaux. This pattern has been previously demonstrated for Chateau Margaux using the industry benchmarks of Liv-ex mid-prices and Parker ratings.

High returns from lesser vintages are principally attributed to lower release prices, shorter drinking times and greater demand. Counteracting these effects are ‘sticky prices’ – that a Chateau will increase the nominal release price in the following years because the wines are trading at a higher price in the marketplace.

The effect of shorter drinking times is persistent: this is logical as scarcity will rarely decrease in the market for fine wines. Below is an example from Lafite [note that Parker scores are displayed in this chart as a subtraction from 100]:

Even in the market peak of 2011, this pattern of lower returns from better vintages existed, however the reverse was true in the peak of 2007/08: at that time the better vintages were doing better. Since then, as Liv-ex put it: “the exceptional vintages [have been hit] more so”.

The first blog in this series picked out a pair of wines from Margaux, and looked at the rates of return over the last 10 years. Lafite presents a good example also: Currently the 1990 and 1991 trade at around the same price, just below SFr 8’800 and SFr9’300 respectively. A decade ago, the mid-prices were around SFr4’000 for the 96 point 1990 and SFr1’750 for the 86 point 1991. It is true to say that a decade ago the 1990 only had 92-94 from Parker, but its points have appreciated more than its price, relative to the following year.

Before 2008, the premium placed on exceptional vintages was high enough to support appreciation within the marketplace, i.e. the en primeur prices had not been excessive given the climate in which they were released. Since then, a drop in demand both from the Chinese market (a change in preferences) and the European market (a shock to disposable income) has meant that more affordable vintages are sneaking ahead.

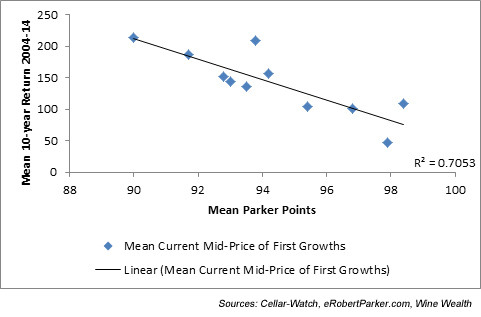

Looking at first growths of Bordeaux as a whole, the below illustrates the correlation between the return over the last 10 years and the Parker score for vintages 1994 – 2004.

It is fair to say that overall there have been higher points awarded in more recent years, so multicollinearity does exist given the naturally higher returns that come with age. However the order of magnitude implies that this could only be a contributory factor; and the pattern was reversed pre-2008 dip.

This market inflection point of 2008 should have changed the way that personal portfolios are organised in order to maximise return, however given the sliding values since 2011, it is likely that many cellars will still be stocked with the best vintages.

Read the next article in this series

Wine Wealth is a consultancy guiding investors on wine as a form of investment. Further information can be found about our service offering, or by contacting us.

Join the conversation with @WineWealth on Twitter